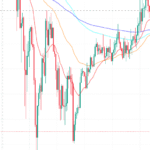

The price movement associated with cryptocurrencies is highly dynamic in nature, with some tokens experiencing even more pronounced fluctuations and theya are consider as The Most Volatile Tokens in Crypto. The most volatile tokens in cryptocurrencies can serve as an opportunity for discerning traders who favor high risk, high reward scenarios. However, it is vital to remember that along with potential reward, huge risk is also associated, as these kinds of assets can value highly in a matter of days, or even within a few hours.

Traders and investors who follow market trends and monitor market psychology can make use of lists detailing the most volatile cryptocurrencies that platforms like TradingView compile on a daily basis. Such lists can also be beneficial for active traders looking for short-term gains.

What is Crypto Volatility?

In a given time frame, the price of cryptocurrency can either be static or dynamic. In the case of dynamic pricing, the extent to which a value rises or falls is measured in comparison to a given period of time. Different cryptocurrencies experience peripheral pricing, where the price for different tokens fluctuates. However, for tokens that experience peripheral pricing, the pricing is different and is way more volatile. The price for these tokens can be affected by social platforms, liquidity, or even speculation by a handful of super wealthy investors. Volatile cryptocurrencies undergo drastic price changes which can be quite unnerving to a trader or investor.

What Factors Contribute To Increased Volatility In Some Tokens?

A token may exhibit a high degree of volatility for the following reasons:

• Low Market Capitalization: Coins with a smaller market capitalization are more vulnerable to price volatility as a result of lower trading volumes and liquidity.

• Speculative Interest: The token surges primarily because of traders jumping on board for reasons that are fundamentally unrelated to the token. Once the speculative phase concludes, prices are reduced significantly.

• External News and Events: Price surges or crashes for tokens relate to outside announcements that have the ability to influence the price such as news on regulation, technology updates, or hacks.

• Whale Movements: Significant trading activity from a single large wallet with thin market liquidity can drastically alter the price of the token.

• Low Liquidity: Tokens that have a smaller trading volume can dramatically change price with a small number of buy or sell orders.

Volatile Tokens Examples

In recent months, some of the assets that have posted the greatest outperformance and underperformance have been meme tokens, game tokens, and newer DeFi projects. Such tokens may include:

• Shiba Inu and Dogecoin: Major price increases and decreases from two of the largest meme tokens heavily influenced by social media.

• Some newly launched DeFi tokens: Often surge on launch but can fall quickly if hype doesn’t last.

• Low-cap altcoins: Due to illiquidity, these may experience 20% or greater price movements within a single day owing to rampant speculation.

Visit TradingView’s volatility list to view live examples, and other applicable metrics.

Who Should Trade Volatile Tokens?

Trading volatile tokens is not universally applicable. These may appeal to:

• Day traders: Individuals who open and close positions within hours or minutes.

• Scalpers: Traders who look to capitalize on minute price movements within a day.

• Speculators: Those willing to risk capital for the chance of fast returns.

On the contrary, the highly volatile markets require a degree of experience, sharp discipline, and a well-defined grasp on risk management. Absent a solid strategy, one’s losses can pile up quickly.

Strategy for Managing Volatility

If you plan to invest or trade in highly volatile cryptocurrencies, consider these strategies:

• Employ Stop-Loss Orders: These will safeguard your capital by automatically shutting a trade at a predetermined loss.

• Profit Taking: Protect accrued profits by establishing automatic sell thresholds.

• Manage Investment Distribution: Do not concentrate all funds on one high-risk token.

• Refrain from Overleveraging: Borrowing funds can drastically increase both gains and losses.

• Stay Informed: Keep an eye on news, social media, market trends, or community announcements that could change the token’s value.

Potential Prospective Advantages and Detriments

Pros:

• Opportunity for rapid earnings during swift price changes.

• Beneficial for seasoned traders with solid trading plans.

• Helpful for assessing market momentum.

Cons:

• Great potential for losing large sums of money in a short time.

• Difficult to forecast price movements with any regularity.

• Emotional strain due to constant and rapid changes in market prices.

Concluding Remarks

Volatile tokens are some of the most exhilarating yet most dangerous assets in the crypto space. They have the potential of substantial investment returns, but these are mainly counter-balanced by the harsh consequences that come with trading them, most especially for beginners. Always perform thorough market analysis before trading and never invest what you cannot afford to lose.

Volatile tokens are the most dangerous assets while still providing the most thrill in the crypto market. They have the potential to offer very high returns, but these are substantially counterbalanced by harsh consequences, particularly for beginners. Always perform your due diligence before trading, and never invest what you cannot lose.

Volatile market fluctuations can still be beneficial for seasoned traders if they stay informed with services like TradingView and make use of risk management tools. However, these traders still need to exercise caution and discipline.