Published: September 1, 2025 – 15:10 UTC

In the ever-evolving world of crypto and forex trading, strategies built on technical indicators remain crucial for traders seeking consistency and clarity. Among the most widely used is the Exponential Moving Average (EMA) strategy, a tool that smooths out price data while giving greater weight to recent price action. In this article, we’ll break down the EMA strategy in detail, analyze the live chart provided, and share SEO-friendly trading tips and AEO-friendly answers to guide traders looking for actionable insights.

What is the EMA Strategy in Trading?

The Exponential Moving Average (EMA) is a type of moving average that reacts more quickly to recent price changes compared to the Simple Moving Average (SMA). Because markets move fast, traders often use EMAs to:

- Identify trend direction

- Spot entry and exit points

- Confirm signals alongside other indicators like RSI (Relative Strength Index) or volume

For example, the EMA 20 and EMA 50 crossovers are popular signals. A bullish crossover (when the short-term EMA crosses above the long-term EMA) often indicates upward momentum, while a bearish crossover suggests a possible decline.

Reading the Current Chart

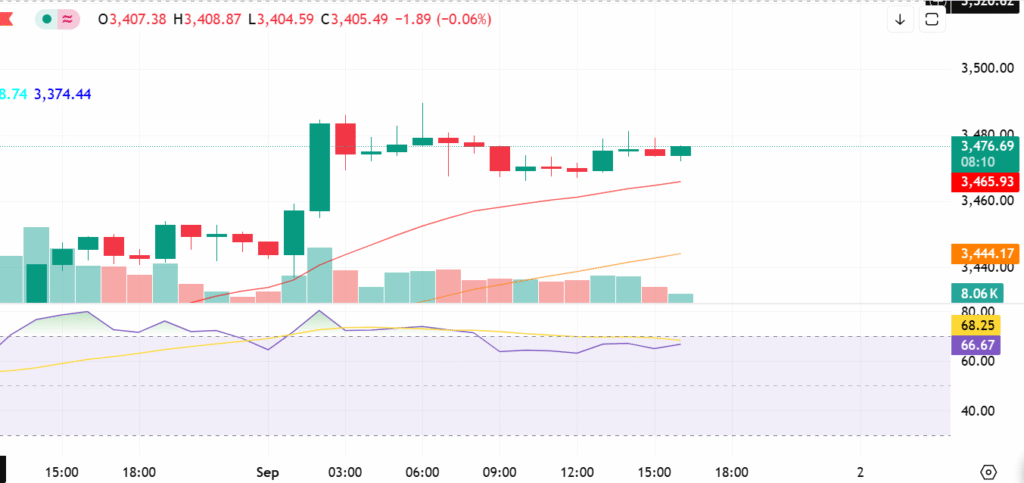

The uploaded chart (dated September 1, 2025) shows a crypto asset trading around the $3,476 zone. Key observations:

- EMA Levels:

- The red EMA line (likely EMA 20) is positioned near 3,465, acting as dynamic short-term support.

- The orange EMA line (possibly EMA 50) sits around 3,444, providing medium-term support.

- Price Action:

- After a sharp bullish surge early in the session, price consolidated sideways.

- The candlesticks show smaller bodies with reduced volatility, suggesting traders are waiting for confirmation.

- RSI Reading:

- Current RSI is around 66.67, very close to the overbought threshold (70).

- This suggests strong bullish momentum but also warns of possible exhaustion.

- Volume:

- The spike in buying volume during the rally confirmed bullish momentum.

- Recent bars show declining volume, a sign of consolidation.

EMA Strategy Applied to This Chart

Here’s how traders could interpret the EMA strategy on this chart:

- Trend Identification

- With price trading above both the EMA 20 and EMA 50, the trend is clearly bullish.

- As long as candlesticks remain above the EMAs, traders may prefer long positions over shorts.

- Entry Points

- A potential entry could be considered on minor pullbacks near the EMA 20 (3,465).

- For conservative traders, waiting for a bounce confirmation from EMA 50 (3,444) adds extra safety.

- Exit or Take Profit Levels

- RSI near 67 suggests the market may soon face selling pressure. A profit-taking zone could be set around 3,500–3,520, the psychological resistance level.

- Stop Loss Placement

- Placing stops below EMA 50 (3,444) provides a cushion against false breakouts.

Tips for Using EMA Strategy Effectively

To maximize results with EMA-based trading, consider these proven tips:

- Combine EMA with RSI: EMA gives trend direction, while RSI shows overbought/oversold conditions. Together, they provide stronger signals.

- Watch for Crossovers: When the short-term EMA (e.g., 20) crosses above the long-term EMA (50 or 200), it signals a potential trend shift.

- Volume Confirmation: Always check if price moves are backed by volume. High volume confirms genuine moves, while low volume may indicate fakeouts.

- Set Alerts: Many trading platforms allow alerts when price touches or crosses specific EMA levels. This ensures you never miss a move.

Common Mistakes Traders Make with EMA

While EMA is powerful, traders often misuse it. Here are mistakes to avoid:

- Relying on EMA Alone: Always use EMA alongside RSI, MACD, or volume. EMA alone may produce false signals in sideways markets.

- Ignoring Market News: Fundamental events (like FOMC announcements or crypto regulations) can invalidate technical setups.

- Overtrading Crossovers: Not every crossover is significant. Look for confirmation before entering trades.

Friendly Quick Answers

Q: What is EMA in trading?

A: EMA (Exponential Moving Average) is a technical indicator that smooths price data, giving more weight to recent movements, and is used to identify trends.

Q: How do you trade with EMA?

A: Traders buy when price is above the EMA and sell when it’s below. Popular strategies involve watching EMA crossovers (e.g., 20 EMA crossing above 50 EMA).

Q: Is EMA strategy profitable?

A: EMA can be profitable when combined with RSI, volume, and risk management, but no strategy guarantees success.

Final Thoughts

The EMA strategy remains one of the most reliable tools for crypto and forex traders. The chart on September 1, 2025, 15:10 UTC highlights a bullish market structure, with price trading above both EMA 20 and EMA 50. However, with RSI nearing overbought levels, caution is advised.

⚠️ Disclaimer: This analysis is for educational purposes only. Trading involves risks, and past performance does not guarantee future results. Always do your own research before making financial decisions.

By blending EMA analysis, RSI confirmation, and volume signals, traders can enhance their edge in volatile markets. Whether you’re a beginner or a pro, sticking to disciplined strategies like EMA ensures you stay on the right side of trends.