Crypto Winter Bargains: The Exploration of the Most Underrated Coins at Their All-Time Low

In the constantly changing field of cryptocurrency, not every token has the chance of skyrocketing in value. Although the headlines are often filled with record new peaks, it’s equally important to focus on the other side as well, coins and tokens that have reached their new all-time lows. The tokens might be currently lying in the red zone, but they often have the chance to present to a few astute traders value in the floor assets. It’s crucial to dive deeper into these assets and analyze what factors contribute to their current positions.

🚨 What Causes Coins to Reach All-Time Lows?

Losing to All-Time lows often reflect some rot and dirt to the effects of the overall, weak token fundamentals to poor technical setups. While every new all-time low brings harsh stressors, there are some factors which includes:

One critical aspect to consider is how market sentiment can fluctuate over time. For instance, the interest in cryptocurrency can surge or drop based on external factors such as regulatory news, technological advancements, or macroeconomic trends. These influences can lead to increased volatility, pushing coins to their all-time lows even when their underlying technology or community remains strong.

Moreover, understanding the dynamics of cryptocurrency markets can also provide insights into investment strategies. The crypto market operates 24/7, influencing liquidity and trading volumes that can affect pricing. Traders and investors should be aware of market cycles and how they impact the price movements of various tokens.

Understanding the dynamics of cryptocurrency markets can also provide insights into investment strategies.

- Unsustainable hype cycles

- No token use case or software updates

- Market trends

- Overextended tokenomics or supply inflation

🔍 Gems or Warning Signs?

In August 2022, after the crash of the usage of NFTs, the hype around metaverses, and crypto on the whole, there were some tokens and coins that balso were on all-time lows which people recognised as hidden.

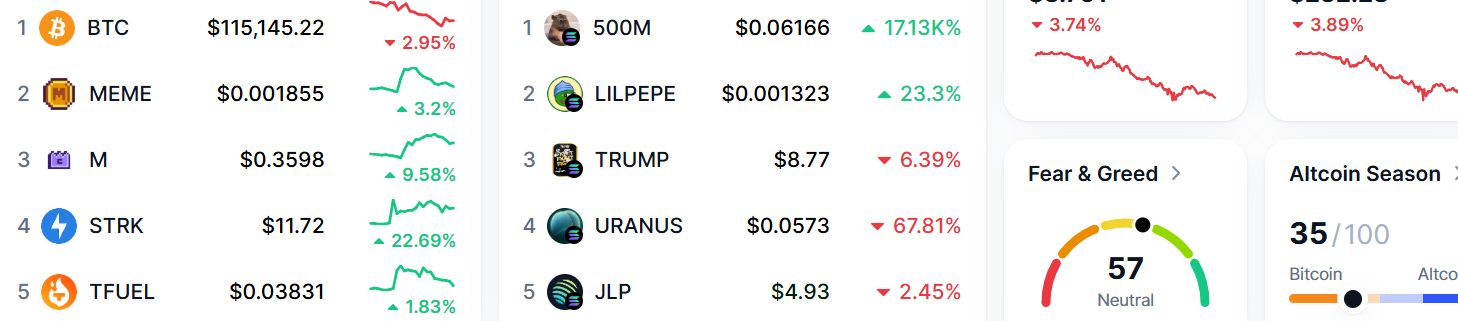

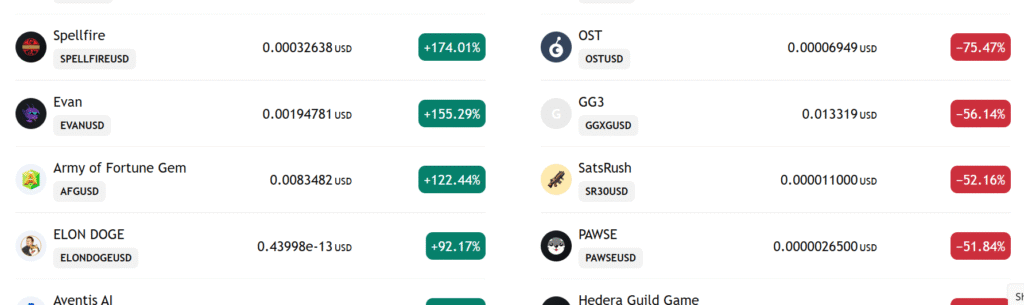

🧨 Coins That Are Currently at Their Lowest Price:

When evaluating coins at their lowest price points, it’s important to consider their market presence and long-term viability. Here are some coins currently at their lows, along with insights into their potential:

- ANITA (Anita AI): Meme sector token at the price of $0.00197 with almost no change in the last 24 hours. Investor interest, regardless of category, stays tepid.

- ARV (Ariva): Ariva trades at $0.00000625 with a massive circulating supply of over 72 billion. It has some utility in payments and the tourism sector, but suffers with adoption.

- BABYBONK (Baby Bonk): Meme token under pressure but with a lot of trading activity relative to total market cap, hence the price in the trillionths of a dollar.

- AVC (AlterVerse): Another gaming token at $0.00034 that has been flagged as a strong sell and underperformed due to poor technicals as a gaming token, though the sector has many investors.

It’s essential to distinguish between a temporary dip in price and a fundamental issue with a token. For example, while a token may be at an all-time low due to market sentiment, there could be underlying developments that indicate a potential turnaround. Analyzing social media sentiment, community engagement, and technological updates can provide valuable insights into whether a token is simply undervalued or fundamentally flawed.

🔧 Metrics of Interest

When looking at tokens, it’s crucial to analyze specific metrics that indicate their health and potential growth:

ANITA (Anita AI): Despite being a meme sector token priced at $0.00197 with almost no change in the last 24 hours, there’s a chance that renewed interest in AI technologies could spark a revival. Investors should monitor trends in the AI space, as they may influence meme tokens positively.

ARV (Ariva): Trading at $0.00000625 and boasting a massive circulating supply of over 72 billion, Ariva has potential use cases in payments and tourism. Investors should keep an eye on partnerships that could enhance its adoption in the market.

BABYBONK (Baby Bonk): This meme token is under pressure but shows a lot of trading activity relative to its total market cap. Investors should consider the meme culture and its potential for resurgence in popularity.

AVC (AlterVerse): Priced at $0.00034, this gaming token has faced challenges due to poor technical performance. However, the gaming sector is robust, and new developments or partnerships could shift its trajectory positively.

- Volume-To-Market Cap Ratio: Higher ratios like AVC at 1.22 show active trading even in lower-priced tokens, hinting at potential liquidity.

- Social Dominance: The measure of attention a token receives relative the the entire market cap, many of the coins on this list have 0.00%, showing that the community is not engaged.

- Tech Ratings: Most tokens rated to sell or strong sell under suggest bearish momentum.

💡 Opportunities Worth Examining

Despite many coins showing a lack of momentum, there are opportunities worth investigating. Factors that could positively influence these tokens include:

For instance, the Volume-To-Market Cap Ratio can reveal how actively a token is being traded, which may provide insights into its liquidity. When examining AVC, a ratio of 1.22 suggests that there’s a significant amount of trading occurring even at lower price points, hinting at potential interest from traders.

Even if most of these coins display a lack of momentum technically, they might be able to pivot if:

Tech Ratings provide insight into market sentiment regarding a token. Most tokens rated to sell suggest bearish momentum; however, shifts in ratings can occur rapidly based on market developments or news. Keeping track of these ratings can assist in making informed investment decisions.

- Dev work either restarts or shifts.

- New partnerships or development of new use cases.

- They gain traction on major exchanges.

Speculative buying interest could be driven by trending narratives such as AI, memes, or gamification for PYN (Paynetic AI), KANG (Kangamoon), or TAMA (Tamadoge).

🚫 Move With Caution

Investing in these coins seems to parallel investing in penny stocks, which are highly speculative with low to no robust fundamentals backing them up. Always utilize a partner team, study the whitepaper, and implement risk management strategies to DYOR (Do Your Own Research) on them.

If developer activities resume or shift focus, this can lead to renewed interest in a token. Additionally, creating new partnerships or developing new use cases can enhance a token’s attractiveness in the marketplace.

Furthermore, gaining traction on major exchanges can significantly influence a token’s visibility and price. Listing on larger exchanges often brings a new wave of investors who may not have considered the token previously.

Investing in these coins seems to parallel investing in penny stocks, highly speculative with low to no robust fundamentals to back them up. Always use partner team, whitepaper, and risk management to DYOR (Do Your Own Research) on them.

Speculative buying interest could be driven by trending narratives such as AI, memes, or gamification for PYN (Paynetic AI), KANG (Kangamoon), or TAMA (Tamadoge). These trends can lead to sudden surges in interest and trading volume.

Last Thoughts

This bear market has identified the builders and the hypers. Although these low coins are currently unfashionable, they might provide those wagering on a market reversal with opportunities. We might discover that today’s underperformers could surprise everyone and become legendary. Keeping an eye on the broader market trends and individual coin developments is crucial for any investor.

In addition, maintaining a diversified portfolio can mitigate risks associated with investments in such volatile assets. This strategy not only helps in managing potential losses but also opens avenues for gains across different sectors within the cryptocurrency landscape.

This bear market has identified the builders and the hypers, and although these low coins are currently unfashionable, they might give those wagering on a market reversal chances. We might discover that today’s under performers could surprise everyone and become legendary.

Keep your guard up, keep learning, and always invest wisely. By understanding the nuances of the cryptocurrency market and recognizing potential opportunities, you can position yourself for success in the long run.

As we conclude, remember that the world of cryptocurrency is not static; it’s constantly evolving. Staying informed and flexible will be your biggest assets when navigating this intricate landscape.